Hearts & Minds has longstanding and deep connections with the Jewish community via local and international donors, speakers, volunteers and the Sohn Conference Foundation.

Statement on Bondi Terror Attack

Hearts & Minds has longstanding and deep connections with the Jewish community via local and international donors, speakers, volunteers and the Sohn Conference Foundation.

2025

Hearts & Minds

Equity Mates reviewed the high conviction stock picks presented at the 2025 Sohn Hearts & Minds Conference.

Nvidia's wild swings and 11 Sohn Hearts & Minds stock picks reviewed

Equity Mates reviewed the high conviction stock picks presented at the 2025 Sohn Hearts & Minds Conference.

2025

Equity Mates

Equity Mates

Discover the ideas, themes, and conversations that shaped an unforgettable milestone year at the 2025 Sohn Hearts & Minds Conference.

Marking a Milestone

Discover the ideas, themes, and conversations that shaped an unforgettable milestone year at the 2025 Sohn Hearts & Minds Conference.

2025

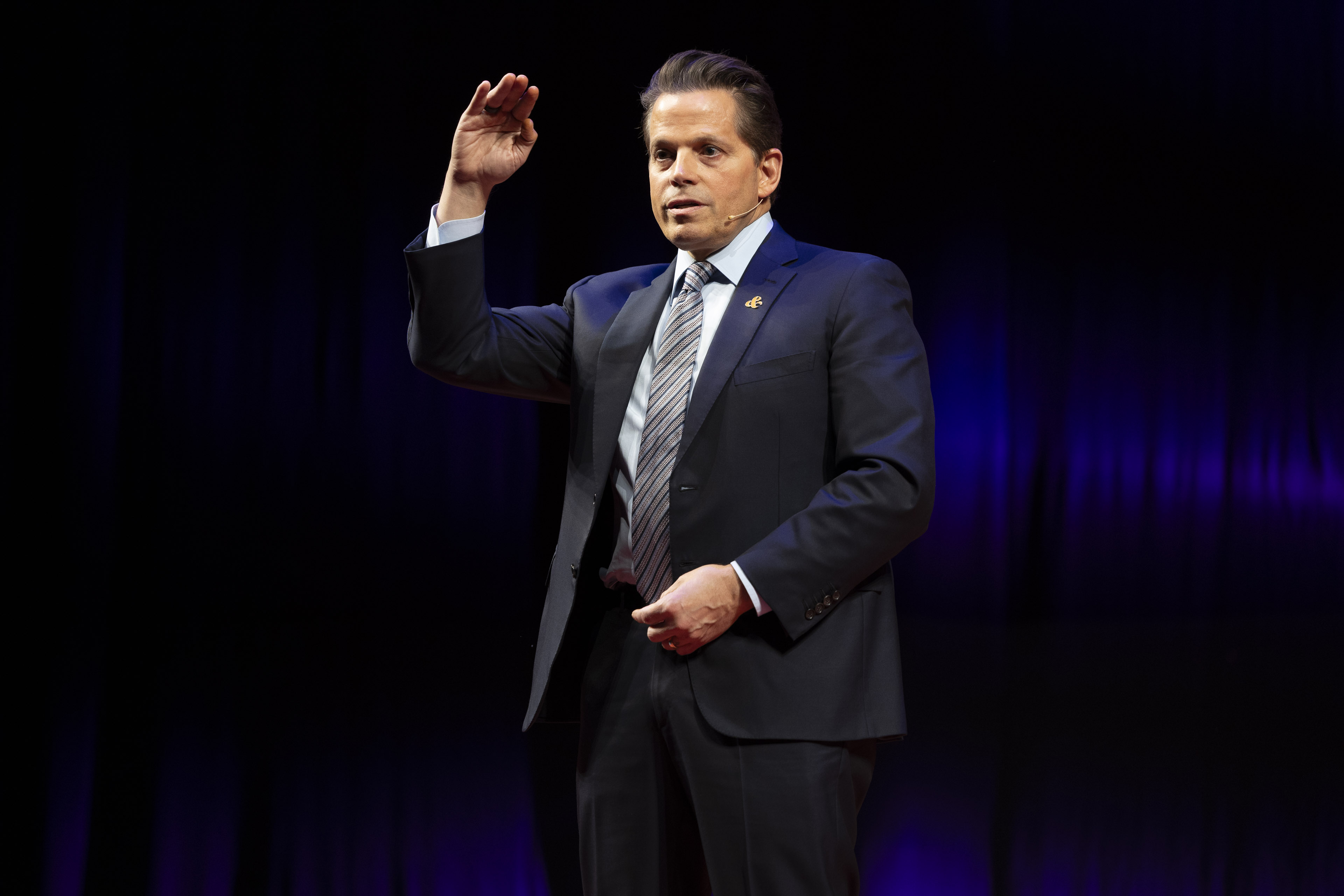

“The Mooch”, as he’s affectionately known, is a man in high demand. He’s flown into Sydney to headline the Sohn Hearts & Minds conference at the Opera House, an investment community jamboree that raises money for charity. He landed in London the night before, and will leave Sydney the next day for the brutal 24-hour return to New York.

Anthony Scaramucci says everyone in Trump's orbit hates him

“The Mooch”, as he’s affectionately known, is a man in high demand. He’s flown into Sydney to headline the Sohn Hearts & Minds conference at the Opera House, an investment community jamboree that raises money for charity. He landed in London the night before, and will leave Sydney the next day for the brutal 24-hour return to New York.

2025

Kishor Napier-Raman

Sydney Morning Herald

We're thrilled to announce Queenstown, New Zealand, as the destination for the 2026 Investment Leaders Conference, to be held on Friday 6 November.

Queenstown to host 2026 Sohn Hearts & Minds Conference

We're thrilled to announce Queenstown, New Zealand, as the destination for the 2026 Investment Leaders Conference, to be held on Friday 6 November.

2025

Hearts & Minds

The federal treasurer got into the spirit of the Sohn Hearts & Minds event with a big-picture investment tip – and a dig at our nation’s fundies.

'Here to pitch the parent company': Jim Chalmers' Sohn pick

The federal treasurer got into the spirit of the Sohn Hearts & Minds event with a big-picture investment tip – and a dig at our nation’s fundies.

2025

James Thomson

Australian Financial Review

Michael Hintze, one of Australia’s richest international billionaires and donor to conservative parties, says the Liberals are lacking a “north star” but dumping net zero was a smart move.

Net zero move good, but Libs need ‘north star’: Lord Hintze

Michael Hintze, one of Australia’s richest international billionaires and donor to conservative parties, says the Liberals are lacking a “north star” but dumping net zero was a smart move.

2025

Matthew Cranston

The Australian

An older, wiser Dan Loeb reckons his activist approach has changed, but the Wall Street icon will never put away the big stick.

Activism without proxy fights is like ‘Catholicism without hell’: Loeb

An older, wiser Dan Loeb reckons his activist approach has changed, but the Wall Street icon will never put away the big stick.

2025

Anthony Macdonald

Australian Financial Review

Defying markets gloom, top investment chiefs pitched their best global ideas, from an “OG in AI” to a retirement giant.

The 9 hottest stock tips from this year’s Sohn fund managers

Defying markets gloom, top investment chiefs pitched their best global ideas, from an “OG in AI” to a retirement giant.

2025

Australian Financial Review

Major investors say the global economy is strong enough to withstand a bubble in artificial intelligence and turmoil in private credit markets despite a sharp fall on Wall Street and the ASX over the past week.

Third Point’s Loeb leads bullish investors despite stock slump

Major investors say the global economy is strong enough to withstand a bubble in artificial intelligence and turmoil in private credit markets despite a sharp fall on Wall Street and the ASX over the past week.

2025

Jonathan Shapiro

Australian Financial Review

Australian investors should be more worried about China than sweating on Federal Reserve independence and other market obsessions to do with Donald Trump, says billionaire conservative Baron Michael Hintze.

Forget Trump volatility says top investor and focus on China threat to Australia

Australian investors should be more worried about China than sweating on Federal Reserve independence and other market obsessions to do with Donald Trump, says billionaire conservative Baron Michael Hintze.

2025

Matthew Cranston

The Australian

Global fund managers gathered at the 2025 Sohn Hearts & Minds conference to pitch their best stock ideas.

10 top stock picks from Sohn Hearts & Minds conference 2025

Global fund managers gathered at the 2025 Sohn Hearts & Minds conference to pitch their best stock ideas.

2025

David Rogers

The Australian

“We’re really looking for people who have that strong growth arc. Even though they’ve reached material scale, they’re still changing and moulding their company to move really fast, and they’re curious.”

Square Peg's Ben Hensman names top picks in a hot tech sector

“We’re really looking for people who have that strong growth arc. Even though they’ve reached material scale, they’re still changing and moulding their company to move really fast, and they’re curious.”

2025

Joanne Tran

Australian Financial Review

It is time we rethink our approach to China? Eric Wong of Stillpoint Investments believes it is time.

Labubu, AI infrastructure & renewable energy: Why China is full of opportunity

It is time we rethink our approach to China? Eric Wong of Stillpoint Investments believes it is time.

2025

Equity Mates

Vihari Ross' global fund returned more than 20 per cent in the year to September 30 versus about 10 per cent for the benchmark without owning Nvidia, Meta, Tesla, Apple or Broadcom.

How to beat the market without owning Nvidia shares

Vihari Ross' global fund returned more than 20 per cent in the year to September 30 versus about 10 per cent for the benchmark without owning Nvidia, Meta, Tesla, Apple or Broadcom.

2025

David Rogers

The Australian

It turns out you could have outperformed the seemingly unstoppable magnificent seven tech stocks if you simply acted on the 11 stock picks at Sohn last year.

The 42pc gain that shows why Sohn is a stock picker’s delight

It turns out you could have outperformed the seemingly unstoppable magnificent seven tech stocks if you simply acted on the 11 stock picks at Sohn last year.

2025

Andrew Hobbs

Australian Financial Review

Qiao Ma has a simple test for spotting the investment opportunities that will define the next decade. Take the technology apart and see what’s inside.

Munro Partners' Qiao Ma reveals AI investment strategy

Qiao Ma has a simple test for spotting the investment opportunities that will define the next decade. Take the technology apart and see what’s inside.

2025

David Rogers

The Australian

Beyond Wall Street, The Mooch is better known for his cutting takes on US politics in the popular podcast The Rest is Politics: US, which he hosts with BBC’s long-term North American correspondent Katty Kay.

Anthony Scaramucci’s advice to our PM is to seek his Canadian counterpart’s counsel

Beyond Wall Street, The Mooch is better known for his cutting takes on US politics in the popular podcast The Rest is Politics: US, which he hosts with BBC’s long-term North American correspondent Katty Kay.

2025

Eric Johnston

The Australian

As we enter our next chapter, we wanted a brand that honours where we’ve come from and reflects where we’re going.

Introducing the Hearts & Minds Ampersand

As we enter our next chapter, we wanted a brand that honours where we’ve come from and reflects where we’re going.

2025

Hearts & Minds Investments

Matthew McLennan, the co-head of the global value team and portfolio manager at the $US161bn ($243bn) First Eagle Investments, stormed the market with a bullish bet on gold.

First Eagle’s Matthew McLennan on the monetary force that could be ‘rocket fuel’ for the Australian dollar

Matthew McLennan, the co-head of the global value team and portfolio manager at the $US161bn ($243bn) First Eagle Investments, stormed the market with a bullish bet on gold.

2025

Matthew Cranston

The Australian

The son of a stockbroker, Mr Mullin has more than 30 years' investing experience and is chief investment officer at Marathon Resource Advisors in San Francisco, a company he founded.

Marathon CIO Robert Mullin reveals why gold stocks are still undervalued

The son of a stockbroker, Mr Mullin has more than 30 years' investing experience and is chief investment officer at Marathon Resource Advisors in San Francisco, a company he founded.

2025

Joseph Carbone

The Australian

Investing veteran Lord Michael Hintze says he’s taking out insurance against expensive debt and equity markets that are being propelled by passive flows.

Billionaire hedge fund manager enacts ‘little short’ on the market

Investing veteran Lord Michael Hintze says he’s taking out insurance against expensive debt and equity markets that are being propelled by passive flows.

2025

Jonathan Shapiro

Australian Financial Review

Billionaire hedge fund manager Michael Hintze says the world is more dangerous than he has ever seen, artificial intelligence is stifling people’s ability to learn and process information.

Hedge fund guru Michael Hintze can't out-trade machines but he can still 'out-invest' them

Billionaire hedge fund manager Michael Hintze says the world is more dangerous than he has ever seen, artificial intelligence is stifling people’s ability to learn and process information.

2025

John Stensholt

The Australian

Eric Wong will present his investment case at the Sohn Hearts & Minds conference at the Sydney Opera House on Friday, November 14.

Stillpoint founder Eric Wong reveals major China tech investment strategy

Eric Wong will present his investment case at the Sohn Hearts & Minds conference at the Sydney Opera House on Friday, November 14.

2025

David Rogers

The Australian

Matthew McLennan’s $14.5 billion position in gold bars and miners paid off handsomely for First Eagle this year. But he insists the precious metal still has room to run.

A golden year for Wall Street’s Australian stock picker

Matthew McLennan’s $14.5 billion position in gold bars and miners paid off handsomely for First Eagle this year. But he insists the precious metal still has room to run.

2025

Jonathan Shapiro

Australian Financial Review

Alex Pollak, Chief Investment Officer at Loftus Peak, has built a reputation for investing on the cutting-edge of disruption. And no doubt, US tech has been a good place to invest over the past decade. But a lot of Australian fund managers have invested in that space, few have matched his returns.

Disruption, Valuation and AI with Alex Pollak of Loftus Peak

Alex Pollak, Chief Investment Officer at Loftus Peak, has built a reputation for investing on the cutting-edge of disruption. And no doubt, US tech has been a good place to invest over the past decade. But a lot of Australian fund managers have invested in that space, few have matched his returns.

2025

Equity Mates

‘The Mooch’ says Trump will have to cut China tariffs below 10pc

2025

Media

James Thomson

The Australian Financial Review

Bitcoin ‘on track’ for $US200,000: Anthony Scaramucci

2025

Media

Eric Johnston

The Australian

On Elon Musk, money and the White House, fast-talking Wall Street hedge fund manager and former Trump communications director Anthony Scaramucci tells it as he sees it.

My biggest mistake: Anthony Scaramucci on what makes Donald Trump tick

On Elon Musk, money and the White House, fast-talking Wall Street hedge fund manager and former Trump communications director Anthony Scaramucci tells it as he sees it.

2025

Media

Eric Johnston

The Australian

Anthony Scaramucci says Trump has fewer constraints on his worst instincts in his second administration. But he still gets bored easily.

Why ‘The Mooch’ thinks Trump is more dangerous this time around

Anthony Scaramucci says Trump has fewer constraints on his worst instincts in his second administration. But he still gets bored easily.

2025

Media

James Thomson

The Australian Financial Review

$1.4 million boost for SA medical research

2025

Media

Government of South Australia

Media Release

Trump unifies top investors in decade-long bullish outlook for US

2024

Jonathan Shapiro, Joshua Peach and Daniel Arbon

These rock-star stock picks could get markets talking next year

2024

Elizabeth Knight

Sydney Morning Herald

Is anyone brave or stupid enough to bet against America?

2024

Jonathan Shapiro

Australian Financial Review

Sohn investors position for bullish but bumpy Trump ride

2024

Glenda Korporaal

The Australian

Eleven stock tips from Sohn to get you through 2025

2024

Joshua Peach, Jonathan Shapiro and Daniel Arbon

Australian Financial Review

Ricki Bannan tips Corporate Travel Management to soar amid travel boom

2024

Media

David Rogers

The Australian

Sohn: NYSE-listed Estee Lauder’s Northcape Capital pick

2024

David Rogers

The Australian

Sohn ASX stock pick: Ellerston Capital’s Chris Kourtis backs Perpetual

2024

Valerina Changarathil

The Australian

Sohn conference: Novogratz on what next for crypto after bitcoin euphoria

2024

Insights

Valerina Changarathil

AI start-ups a threat to incumbent big companies, Paul Bassat tells SOHN conference

2024

John Stensholt

The Australian

Howard Marks and Sohn’s big stars reveal seven rules for investing

2024

James Thomson

Australian Financial Review - Chanticleer

Billionaires, bankers and fundies rev up Adelaide at annual Sohn bash

2024

James Thomson and Jonathan Shapiro

Australian Financial Review

Sohn Hearts & Minds Investments fund targets $1.5bn valuation

2024

Glenda Korporaal

The Australian

Former NSA chief Mike Rogers believes Donald Trump will question AUKUS but ultimately support it

2024

Cameron Stewart

The Australian

Sohn Hearts & Minds Conference to feature international panellists talking Trump 2.0

2024

Glenda Korporaal

Australian

Australia’s rocket industry reaches a crucial inflection point

2024

Tess Bennett

Australian Financial Review

Galaxy Digital CEO Mike Novogratz believes bitcoin will hit $US100k

2024

Anthony Kean

The Australian

Lanyon Asset Management boss David Prescott putting Adelaide on the map

2024

Giuseppe Tauriello

The Australian

We just got an early warning Trump could threaten the bull market

2024

James Thomson

Australian Financial Review, Chanticleer

Why this New York hedge fund manager sees opportunity in European stocks

2024

David Rogers

The Australian

The fundie betting big on China – with help from AI

2024

Cliona O’Dowd

The Australian

The portfolio manager says defensive stocks pose a bigger risk than the magnificent seven for investors that are overexposed to the American sharemarket.

Antipodes’ Ross says short-term wealth hinges on US election

The portfolio manager says defensive stocks pose a bigger risk than the magnificent seven for investors that are overexposed to the American sharemarket.

2024

Jonathan Shapiro

Australian Financial Review

The concentration risk in global stock indexes that has built up during the strong rise over the past year must now be a key consideration for global investors, according to Vihari Ross.

Concentration risk key for investors: Antipodes Partners’ Vihari Ross

The concentration risk in global stock indexes that has built up during the strong rise over the past year must now be a key consideration for global investors, according to Vihari Ross.

2024

David Rogers

The Australian

Premier national investment conference to supercharge SAHMRI research

2024

SAHMRI

Cryptocurrency to fare well under Donald Trump presidency

2024

Glenda Korporaal

The Australian

Why this fundie wants you to ‘wince’ at his stock picks

2024

James Thomson

Australian Financial Review, Chanticleer

IFM Investors’ Rikki Bannan backs small cap investments to rebound after mixed performance

2024

Glenda Korporaal

The Australian

Chris Kourtis is on a winning streak. Here’s his next ASX pick

2024

Joshua Peach

The Australian Financial Review

Why Ellerston Capital’s Chris Kourtis plans to back a ‘hated’ stock

2024

Glenda Korporaal

The Australian

Alex Pollak champions rewards of disruptive investment

2024

Glenda Korporaal

The Australian

Sumit Gautam - Why AI won't deliver in 2025 | Scalar Gauge

2024

Equity Mates

Missed out on Nvidia and Ozempic? This fundie says it’s never too late

2024

Sarah Jones

Australian Financial Review

Northcape Capital’s Fleur Wright on why it’s still early days in the Gen AI boom

2024

David Rogers

The Australian

Scalar Gauge Fund founder Sumit Gautam cautious about over-hyped AI

2024

Giuseppe Tauriello

The Australian

Want a roll-up play that actually works? Try software, for now

2024

Jonathan Shapiro

Australian Financial Review

The Wellcome Trust’s Nick Moakes made a 100-year bet. It’s paying off

2024

Jonathan Shapiro

Australian Financial Review

Building Hearts and Minds with Co-Founders Matthew Grounds and Guy Fowler

2024

Hearts & Minds

Howard Marks on investing: Hold long and fail smart

2024

Eric Johnston

The Australian

‘Ignore the past’: How Howard Marks would size up Nvidia

2024

Eric Johnston

The Australian

Why Howard Marks says you’re making a big mistake

2024

James Thomson

Chanticleer, Australian Financial Review

Honesty the only policy that matters, says Wellcome Trust’s Nicholas Moakes

2024

Glenda Korporaal

The Australian

Fowler toasts Sohn legacy

2024

Glenda Korporaal

The Australian

For the first time in its seven-year history, Sohn Hearts & Minds, Australia’s premier investor event and thought leadership conference will be held in Adelaide in November 2024.

Premier investment conference to be held in Adelaide

For the first time in its seven-year history, Sohn Hearts & Minds, Australia’s premier investor event and thought leadership conference will be held in Adelaide in November 2024.

2023

Sohn Hearts & Minds

Media Release

The 12 hottest stock tips from this year’s Sohn experts

2023

The Australian Financial Review

Webster Financial ‘avoided the mistakes of US bank failures’

2023

David Rogers

The Australian

How Daniel Loeb, the real Bobby Axelrod, made his Wall Street billions

2023

Eric Johnston

The Australian

Cash is king, even for professional investors

2023

Colin Kruger

Sydney Morning Herald

ARK founder Wood backs bitcoin, banking on spot ETF approval

2023

David Roger

The Australian

‘I know it sounds crazy’: Cathie Wood’s next big idea

2023

James Thomson

Australian Financial Review, Chanticleer

Why stock picker Cathie Wood of ARK can’t stand Google

2023

Eric Johnston

Australian

Investors sound warning on private equity timebomb

2023

Jonathan Shapiro

Australian Financial Review

Wise share price could rise 50pc by 2025, says Munro Partners

2023

Paulina Duran

The Australian

Hot stocks to ride the next healthcare trends

2023

Glenda Korporaal

Australian

Ashish Swarup - Invest in snacks, let's get that bread | Aikya Investment Management

2023

Equity Mates

Hedge fund veteran talks lowest moment in Toscafund’s 23-year run

2023

Joshua Peach

Australian Financial Review

The ‘Armageddon scenario’ worrying the Future Fund CIO

2023

Jonathan Shapiro

Australian Financial Review

Future Fund weighs up AI productivity riddle

2023

David Rogers

The Australian

Advancing medicine is in Daniel MacArthur’s DNA

2023

Glenda Korporaal

The Australian

Daniel Loeb’s Wall St hedge fund Third Point raises bets on corporate credit crunch

2023

Eric Johnston

The Australian

Australia’s best stock pickers have just eight minutes to convince the country’s top money managers they have found an investment gem that the market has overlooked.

Five secrets to delivering the perfect pitch

Australia’s best stock pickers have just eight minutes to convince the country’s top money managers they have found an investment gem that the market has overlooked.

2023

Patrick Durkin

AFR BOSS Magazine

Bond bullish on commodity stocks, uranium

2023

Glen Norris

The Australian

This hedge fund manager is making a 100-year bet on luxury

2023

Joshua Peach

Australian Financial Review

How Munro will pick its next stock winner

2023

Paulina Duran

The Australian

The Australian at the centre of Dalio’s Bridgewater – who loves it

2023

Jonathan Shapiro

Australian Financial Review

Big thinkers in hunt for brain cancer cure

2023

Glenda Korporaal

Australian

Meet the Goldman Sachs legend shaking up venture capital

2023

James Thomson

Australian Financial Review, Chanticleer

Tom Naughton - There's money in mi goreng | Prusik Investment

2023

Equity Mates

Why Chris Kourtis just bought CSL and ResMed

2023

Joshua Peach

Australian Financial Review

Paradice and Lew on their love of medical research – and Greece

2023

Jemima Whyte

The Australian Financial Review