Deltroit Asset Management

First Eagle Investments

SkyBridge

Third Point

We’ve hosted industry legends like Ray Dalio, Charlie Munger and Howard Marks, luminaries such as Red Notice author Bill Browder, entrepreneur Prof Scott Galloway and behavioural scientist Prof Dan Ariely and entertainers including Andrew Denton, Daryl Braithwaite and The Mark Seymour Trio of Hunters & Collectors.

Sohn Hearts & Minds brings together top investment, scientific and philanthropic minds - all in support of medical research. The event offers a unique forum for industry leaders and global thought leaders to network, access exclusive insights and support critical medical research.

Inspired by the renowned Sohn New York Conference, Sohn Hearts & Minds features lightning stock pitches, dynamic panels and international keynotes.

600+

community of over 7,500

32+

over 169 alumni

$1tr

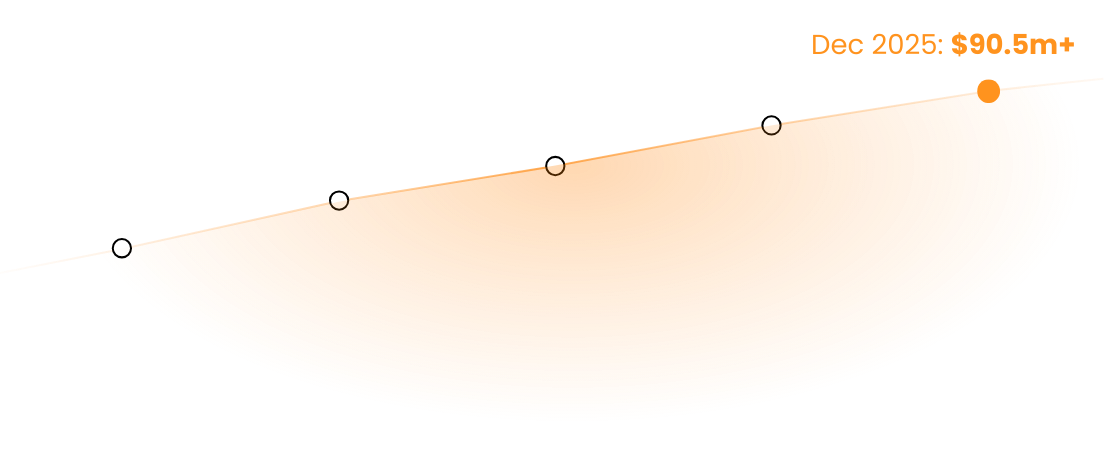

$90m+

with HM1 since 2016

Proudly philanthropic, our beneficiaries are at the forefront of medical innovation, tackling today’s most pressing health challenges. From improving cardiovascular treatments to pioneering breakthroughs in genomics, reducing the incidence of cerebral palsy, advancing cancer immunotherapies and researching new neurological disease treatments.

HM1 is a philanthropic ASX-listed investment company that invests part of its portfolio in the ideas presented at Sohn Hearts & Minds, while also supporting Australian medical research.

Gain access to selected world class fund managers who donate their expertise and top ideas to HM1.

Invest in a high conviction global equities portfolio underpinned by a fully franked dividend.

Support a range of groundbreaking Australian medical research, with 1.5 % of NTA donated annually.